The

MARKET

The MARKET

The Saudi Exchange is one of the main pillars of the Saudi economy and the Financial Sector Development Program within the Kingdom of Saudi Arabia's Vision 2030. The Saudi Exchange supports the Kingdom in building a thriving economy supported by an advanced, integrated, and developed technological financial market.

To achieve the Saudi Exchange vision and mission, a strategy for growth and diversification is followed through the development of new assets, products, and services and the mechanism for their implementation, while strengthening interdependence with other financial markets in the region and the world to facilitate capital formation.

Monthly Snapshot

Statistics on Saudi Exchange’s markets, displaying the market performance and investor trends. The statistics are updated each month.

Saudi Capital Market Profile

| As of the End of July 2023 | ||

|---|---|---|

| Trading Information | Main Market | Nomu – Parallel Market |

| Number of Listed Companies | 210 | 63 |

| Number of Listed Funds1 | 28 | 1 |

| Number of Listed Sukuk & Bonds | 68 | |

| Industry Groups | 21 | 13 |

| Number of Exchange Members | 31 | |

| Market Capitalization2 | 2,936,797,170,488 (USD) | 2,936,797,170,488 (USD) |

| Traded Value2 | 197,444,706,220 (USD) | 1,220,452,127 (USD) |

1: Including REITs, CEFs, and ETFs

2: Excluding CEFs, ETFs & Sukuk.

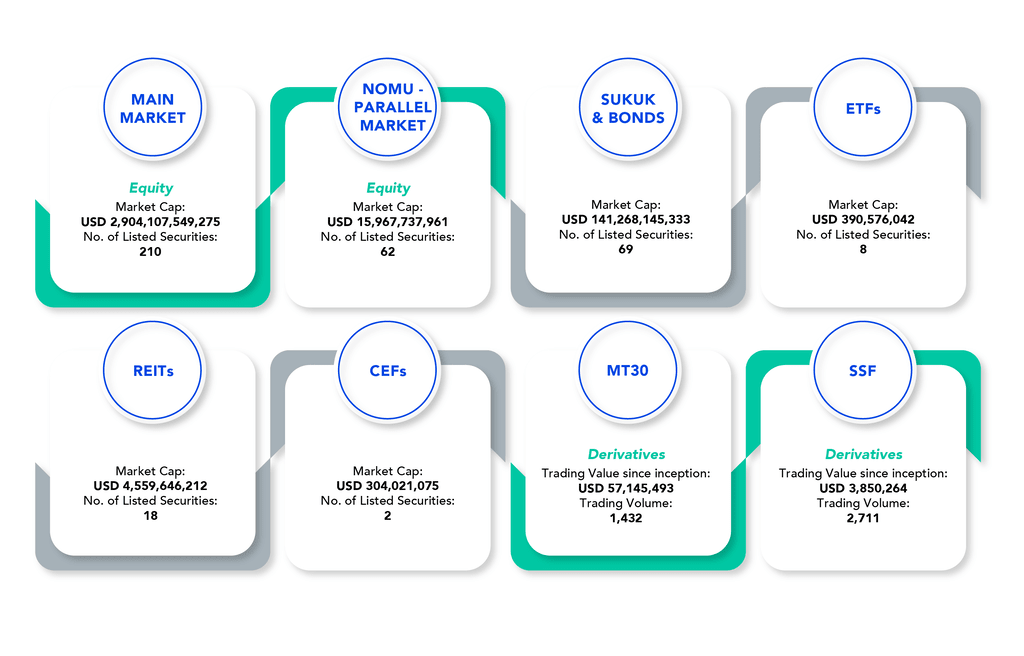

Trading Platforms

The Saudi Exchange offers a range of investment opportunities that include Main Market Equities, Parallel Market - Nomu Equities, REITs, Debt, ETFs, CEFs, and Derivatives.

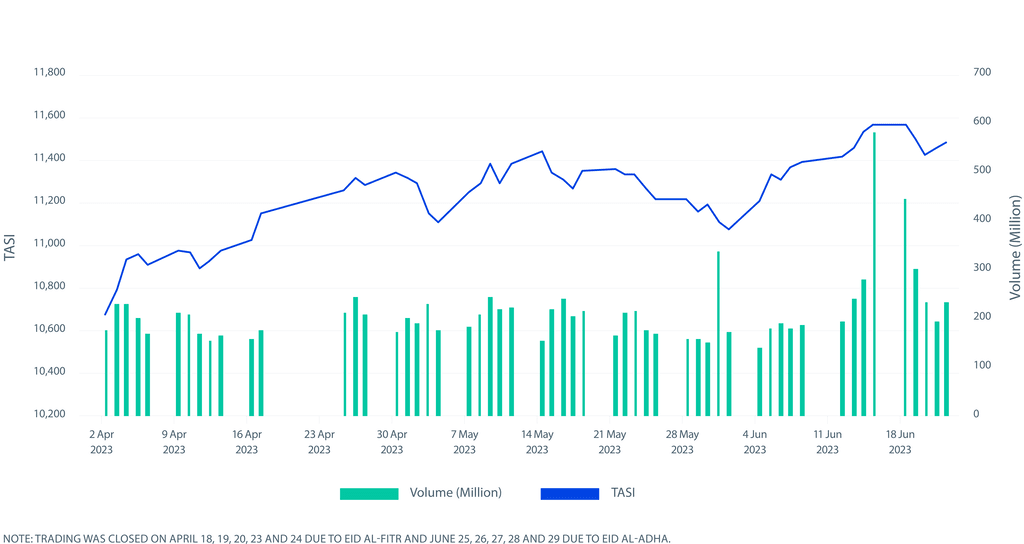

TASI Index Performance with Volume and Value Traded

Monthly TASI performance, which shows the volume and value traded.

Investors Ownership in the Saudi Exchange

A diverse range of participants are active in the Saudi Exchange markets ranging from retail investors to Saudi and foreign institutional investors.

Saudi investors are the most active traders on the Saudi Exchange markets.

Saudi Exchange Tradable Securities

The Capital Market Authority (CMA) and the Saudi Exchange have developed a mechanism for listing and trading Rights of companies listed in the market. The objective is to continuously develop and improve products and services provided to investors, and to introduce new tradable investment tools in order to diversify and expand available investment channels. The Rights will be listed in the trading system and will be tradable during daily trading hours through buy and sell orders, in addition to allowing offering via the same trading system.

| Security Type | Opening Days | Opening Auction | Continuous Trading | Closing Auction | Trade At Last | Settlement Cycle | Minimum Lot | Total Trading Commission | Security Format |

|---|---|---|---|---|---|---|---|---|---|

| Tradable Rights | Sunday - Thursday | 09:30–10:00* | 10:00– 15:00 | 15:00-15:10* | 15:10-15:20 | T + 2 | 1 Right | 15.5 bps | Electronic Form |

Enhancements to the Sukuk and Bonds Market represent an important step in developing the Kingdom’s public debt market by encouraging issuers to list more Sukuk and Bonds in Saudi Riyals, which will increase market liquidity as a result. Increased liquidity in the public debt market will, in turn, contribute to the issuance of more diversified debt instruments and the introduction of new asset classes for investors.

You can view details of Sukuk and Bonds and market activity on the Saudi Exchange website

| Security Type | Opening Days | Opening Auction | Continuous Trading | Closing Auction | Trade At Last | Settlement Cycle | Minimum Lot | Total Trading Commission | Security Format |

|---|---|---|---|---|---|---|---|---|---|

| Sukuk/ Bonds | Sunday - Thursday | 09:30–10:00* | 10:00– 15:00 | - | - | T + 2 | Depending on issuance terms & conditions | Trading commission: 0.5 bps Brokerage services fees: no minimum or maximum fee | Electronic Form |

The development of the ETF market is a major milestone in the creation of a fully-fledged financial ecosystem. All Saudi Exchange ETFs are traded on the exchange’s sophisticated trading platform, with all trades matched, confirmed, and executed electronically following a T+2 settlement cycle.

In addition, the Securities Depository Center Company (Edaa) and Securities Clearing Center Company (Muqassa) offers a range of post-trade services to ETF investors including depository services, registry of ETF, transfer of ETF ownership, ETF ownership restriction, and release, clearing & settlement related services, consolidated reporting, asset servicing, and other related services.

You can view details of ETFs and market activity on the Saudi Exchange website

| Security Type | Opening Days | Opening Auction | Continuous Trading | Closing Auction | Trade At Last | Settlement Cycle | Minimum Lot | Total Trading Commission | Security Format |

|---|---|---|---|---|---|---|---|---|---|

| ETFs | Sunday - Thursday | 09:30–10:00* | 10:00– 15:00 | - | - | T + 2 | 1 Unit | 15.5bps | Electronic Form |

The Capital Markets Authority (CMA) issued a regulatory framework for listed Real Estate Investment Trusts (REITs) in 2016, and the first REIT was listed on Saudi Exchange in November 2016. Saudi Exchange listed REITs give investors access to low-cost, liquid instruments through which they can gain exposure to the largest real estate market in the MENA region. In June 2019, the Saudi Exchange achieved the inclusion of Saudi REITs in the global real estate index the FTSE European Public Real-estate Association (EPRA) Nareit Emerging Market Index, helping to enhance the visibility of the Saudi REITs market to international investors, further broadening the investor base, and increasing disclosure standards.

You can view details of REITs and market activity on the Saudi Exchange website

| Security Type | Opening Days | Opening Auction | Continuous Trading | Closing Auction | Trade At Last | Settlement Cycle | Minimum Lot | Total Trading Commission | Security Format |

|---|---|---|---|---|---|---|---|---|---|

| REITs | Sunday - Thursday | 09:30–10:00* | 10:00– 15:00 | 15:00-15:10* | 11:10 -11:20 | T + 2 | 1 Unit | 15.5bps | Electronic Form |

Closed-Ended Investment Traded Fund is a financial instrument issued to the public and traded on the Saudi Exchange, allowing all types of investors to obtain investment exposure to a diverse set of underlying assets.

Closed-Ended Investment Traded Fund consist of units, where each unit represents ownership in the underlying asset. Closed-Ended Investment Traded Fund is traded on the Saudi Exchange just like REITs and Equities during trading hours.

With regard to control and supervision, similar to other investment vehicles, Closed-Ended Investment Traded Fund adhere to the rules and regulations issued by the CMA. Closed-Ended Investment Traded Fund is subject to the high standards of transparency and disclosure set out in the Closed-Ended Investment Traded Fund instructions.

You can view details of CEFs and market activity on the Saudi Exchange website

| Security Type | Opening Days | Opening Auction | Continuous Trading | Closing Auction | Trade At Last | Settlement Cycle | Minimum Lot | Total Trading Commission | Security Format |

|---|---|---|---|---|---|---|---|---|---|

| CEFs | Sunday - Thursday | 09:30–10:00* | 10:00– 15:00 | 15:00-15:10* | 15:20 -15:30 | T + 2 | 1 Unit | 15.5bps | Electronic Form |

The launch of the derivatives market is part of the Saudi Exchange’s strategy to provide investors with a full and diversified range of investment products and services and is a significant further step to the Saudi capital market development.

The first derivatives product offered by Saudi Exchange was the MT30 Index Futures – which is a cash-settled index futures contract based on the MSCI Tadawul 30 index (MT30). The MT30 index provides investors with a benchmark of the largest and most liquid securities listed on the Saudi Exchange and serves as a strong foundation for the development of index futures contracts and exchange-traded derivative products.

Single Stock Options is the third product to be introduced on the Saudi derivatives market. This follows the launch of the MT30 Index Futures Contract in August 2020 and the Single Stock Futures (SSFs) contracts in July 2022. This new product will further enhance the Exchange’s suite of products and exemplifies our efforts to provide investors with diversified offerings and new investment opportunities.

You can view details of Derivatives and market activity on the Saudi Exchange website

| Security Type | Opening Days | Opening Auction | Continuous Trading | Closing Auction | Trade At Last | Settlement Cycle | Minimum Lot | Total Trading Commission | Security Format |

|---|---|---|---|---|---|---|---|---|---|

| Derivatives | Sunday - Thursday | 09:00–09:30 | 09:30– 15:30 | NA(LTP) | - | T + 0 | One contract | SAR 25 | Electronic Form |